Blog

Filter by category:

Why Local Car Sellers Choose Abbeywood Motors

When it comes to selling your car, you have two main choices. You can go with a big national chain that promises instant sales but often delivers less money and more hassle. Or you can choose a trusted local buyer like Abbeywood Motors, where you’ll get a fair price, personal service, and the convenience of free home collection.

Read more

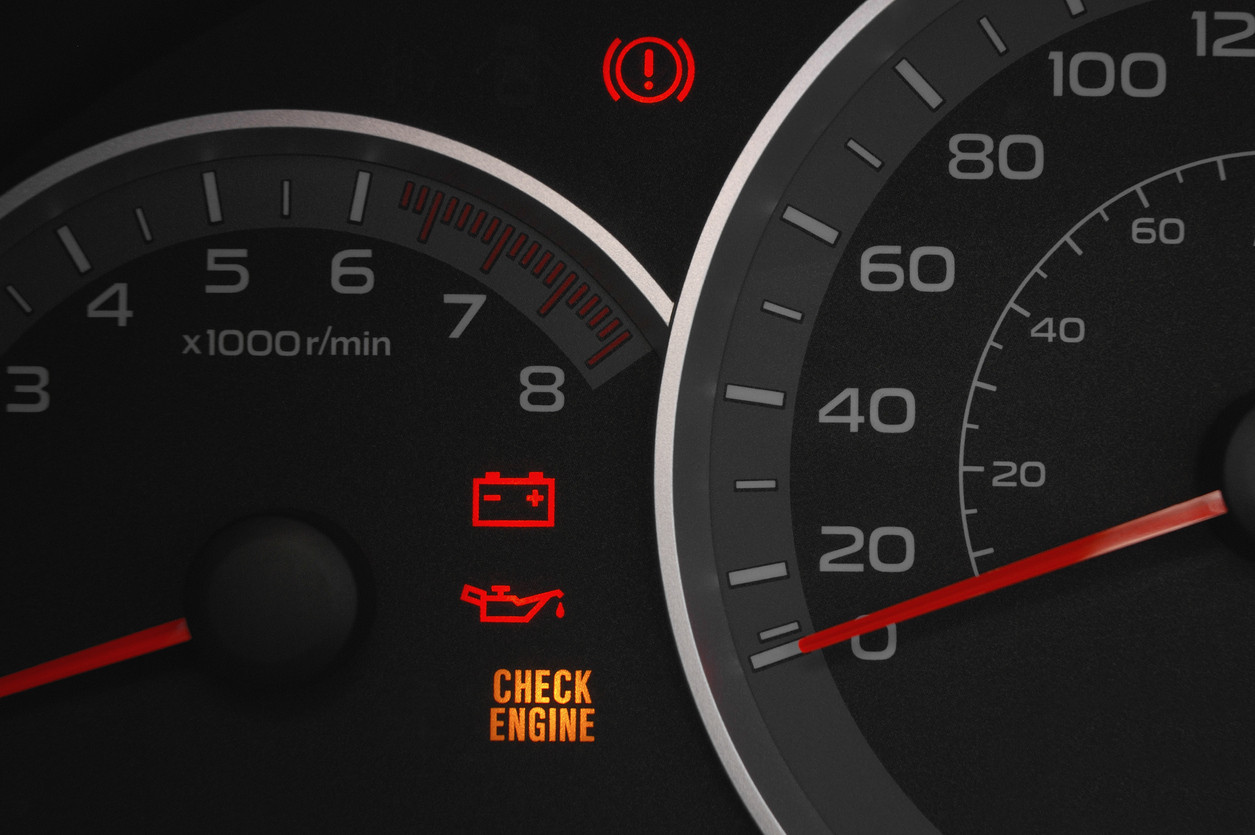

7 Ways You Could Be Damaging Your Car’s Value

Anyone selling their car wants to get the best possible price. We've compiled this handy guide to help you achieve this for your car and avoid common pitfalls that can reduce a car's value.

Read more

Forward Planning Tips to Help You Sell Your Car

Keeping on top of the ongoing maintenance of your car will help you get a better deal when the time comes for you to sell it. There are a number of things that will help to keep your existing vehicle in tip-top shape - discover these here!

Read more

How to Avoid Damaging Your Car During Long Summer Journeys

Our expert tips for preparing your car for long summer journeys, to help you avoid any damage or breakdowns!

Read more

Summer Care Tips That Will Help You Sell Your CarfCoolant Levels

Now the warmer weather has started to arrive, there are a number of things you can do to help keep your car running in optimum condition. These tips will make your vehicle safer to drive and should also help to maintain its value.

Read more